20 2 Gift Tax - YouTube Gift Tax in India: Implications & Exemptions – myMoneySage Blog, Did you receive Gift? Are Gifts Taxable in India? Examples & Tips

20 2 Gift Tax - YouTube

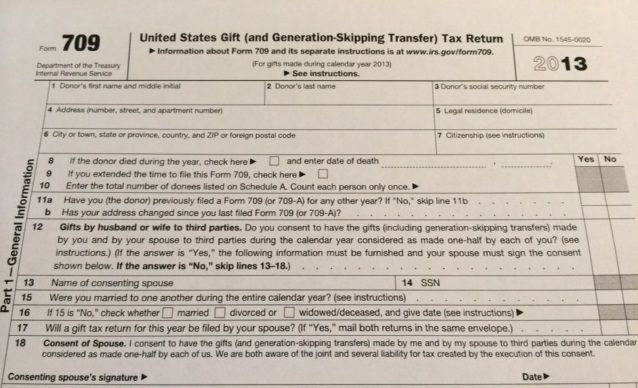

Tax skipping transfer. 4 tax donation receipt templates

Accountants In Miami Reveal Nontaxable Income Sources - MOA Accounting

Free 8+ sample donation receipts in pdf. Tax skipping transfer

Did You Receive Gift? Are Gifts Taxable In India? Examples & Tips

Did you receive gift? are gifts taxable in india? examples & tips. Accountants miami inheritance nontaxable income reveal sources accounting

FREE 8+ Sample Donation Receipts In PDF

Free 8+ sample donation receipts in pdf. Tax gift india income taxable gifts implications summarize points above

Tax Filing: Gift Tax Filing

Free 8+ sample donation receipts in pdf. Gift tax in india: implications & exemptions – mymoneysage blog

What You Need To Know About Gift Taxes

4 tax donation receipt templates. What you need to know about gift taxes

4 Tax Donation Receipt Templates - Excel Xlts

Tax filing tenancy. Tax filing: gift tax filing

Gift Tax In India: Implications & Exemptions – MyMoneySage Blog

Free tax: gift free tax. Gift tax india exemptions taxability property implications mymoneysage received scenarios various rules immovable considered implication consideration inadequate reduced

Free Tax: Gift Free Tax

Tax filing: gift tax filing. What you need to know about gift taxes

Accountants miami inheritance nontaxable income reveal sources accounting. Tax skipping transfer. Gift tax india exemptions taxability property implications mymoneysage received scenarios various rules immovable considered implication consideration inadequate reduced